+1 (561)3354095

Customized Mortgage Financing

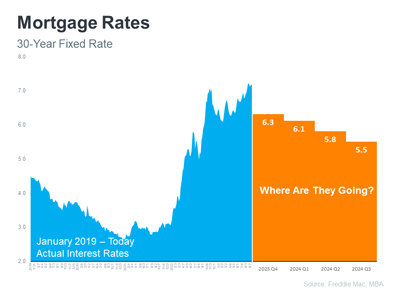

Interest Rates Comparison and Personalized Structuring of Mortgage Loans

Get customized solutions for your property purchase or refinancing.

Learn More About Diana Gallego

Who is Diana Gallego?

I’m Diana Gallego, originally from Medellín, Colombia. At 18, I emigrated to the U.S. and earned a degree in International Business from Florida Atlantic University (FAU). With over 15 years of experience in the mortgage industry, I recently launched my own brokerage, Smart Loans LLC. As a Certified Mortgage Advisor, I’m dedicated to providing personalized, transparent mortgage solutions to clients from the U.S. and Latin America, helping them achieve their homeownership and investment goals with integrity and expertise.

How can I help you?

Discover my Services

Mortgage agent

Why use a Mortgage Broker?

A Mortgage Broker provides access to multiple financing options, comparing rates and terms to find the best deal. Their experience and market knowledge guide you through every step of the process, from pre-approval to closing, ensuring a smooth and efficient transaction.

Experience, Commitment and Results

Why work with me?

Explore the top three reasons to choose to work with me

Frequent questions

Do you have questions?

Find quick answers to your questions about mortgages and financing. From loan requirements to tips for improving your credit, we’re here to help.

Can’t find what you need?

What are the requirements to obtain a mortgage?

The requirements vary depending on the lender and the type of loan, but they generally include a credit history, stable income, and a down payment.

How long does the mortgage approval process take?

The time varies, but it usually takes 30 to 45 days from application to closing, depending on factors such as the complexity of the loan and the efficiency of the lender.

What is a credit score and how does it affect my ability to obtain a mortgage?

A credit score is a number that represents your credit history. A higher score generally means a better interest rate and loan terms.

What additional costs should I expect when buying a house?

In addition to the down payment, you should consider closing costs, taxes, insurance, and moving expenses.